6 Key Trends in Healthcare Payments to Watch

With emerging digital solutions and established healthcare payment and financing partners, providers are bridging the gap between what consumers want and need and what providers can offer.

By Pamela Cagle

Posted Sep 13, 2024 - 7 min read

Sometimes it’s hard to find the middle ground between what a health and wellness consumer wants and needs and the reality of modern healthcare delivery and payment systems. Fortunately, thanks to emerging digital solutions and established payment and financing partners, payments are becoming easier to manage.

In this article, you’ll find the latest trends in healthcare payments. This information may help you better understand your patients’ needs and allow you to approach payments more strategically. But before getting to the key trends in healthcare patient payments, it’s helpful to understand the impact Coronavirus (COVID-19) pandemic had on healthcare and the health and wellness industry.

Ways the Early Coronavirus Pandemic Affected Payers and Patients

As the first wave of coronavirus spread across the United States in March 2020, health and wellness care as we knew it rapidly changed. In the ensuing months, joblessness rose as hospital emergency rooms filled, and all but the most essential workers were asked to shelter in place. When priorities shifted, both payers and providers had to pivot in unprecedented ways.

Government Response

During the pandemic, government payers such as Medicare expanded their services to improve access to care as follows.

- Telehealth

To expand access to healthcare, the Centers for Medicare and Medicaid Services (CMS) and the Department of Health and Human Services (HHS) worked with video conferencing vendors such as Skype, FaceTime, and Zoom to create HIPAA-compliant channels for telehealth visits. - Hospital Without Walls (HWW)

The HWW program allowed Medicare patients to receive care “off campus” at facilities where they didn’t ordinarily receive care. - Reduced patient responsibility

State-funded Medicaid programs waived cost-sharing portions. - Expanded enrollment

Healthcare Marketplace Programs opened enrollment for the newly unemployed.

Commercial Insurance Response

Meanwhile, commercial insurers' responded to federal regulations like the CARES Act by waiving cost sharing for coronavirus testing and expanding the use of telehealth.

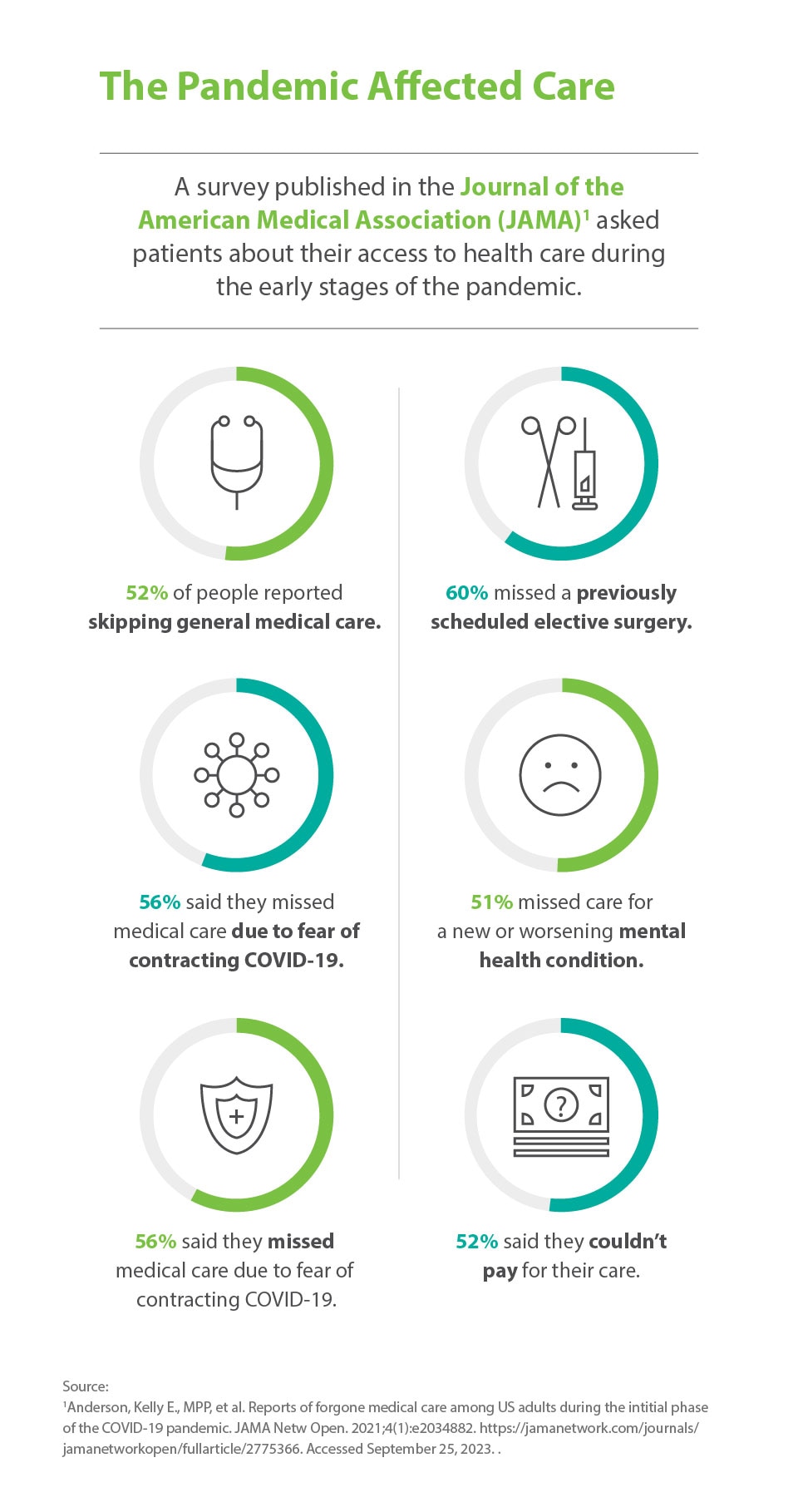

Patient Response to Coronavirus

On the patient level, the early stages of the pandemic forced many people to forego medical care. According to a study published in the Journal of the American Medical Association (JAMA), of respondents who needed care during the early stages of the pandemic:

- 52 percent reported skipping general medical care.

- 60 percent missed a previously scheduled elective surgery.

- 58 percent didn’t get preventive care.

- 51 percent missed care for a new or worsening mental health condition.

- 56 percent said they missed medical care due to fear of contracting the coronavirus.

- 52 percent said they couldn’t pay for their care.

Reasons Patients Delayed Care

Although many coronavirus restrictions eventually lifted and doctors' offices opened to see more patients, the flow of patients didn’t immediately return to pre-pandemic levels as some expected.

Many factors probably contributed to people continuing to delay care. For example, employment fluctuations may have played a role. More than 39 million people quit their jobs in 2021 in what some experts call “The Great Resignation.”

It’s clear many people had access to insurance. By early 2023, enrollment in Affordable Care Act (ACA) marketplace plans had reached an all-time high. Unfortunately, having health insurance doesn’t always mean a patient can pay their medical bills. In a Gallup poll, 38% of people said they’d delayed care in 2022 due to cost.

Research has shown that delaying or avoiding care can lead to poorer outcomes. The pandemic made those effects more obvious — but at the same time it inspired solutions to the problems.

Trends in Healthcare Payments Beyond the Pandemic

What if you could improve the patient experience, increase retention, and boost engagement by understanding what each patient needs? Many of the healthcare payment system trends we’ll cover in this article focus on the patient’s financial experience. Today’s patients are empowered healthcare consumers. They comparison shop for prices that fit their budget and search for the best value for their money. Your patients want payment options that make sense for their situation.

Patients need payment flexibility.

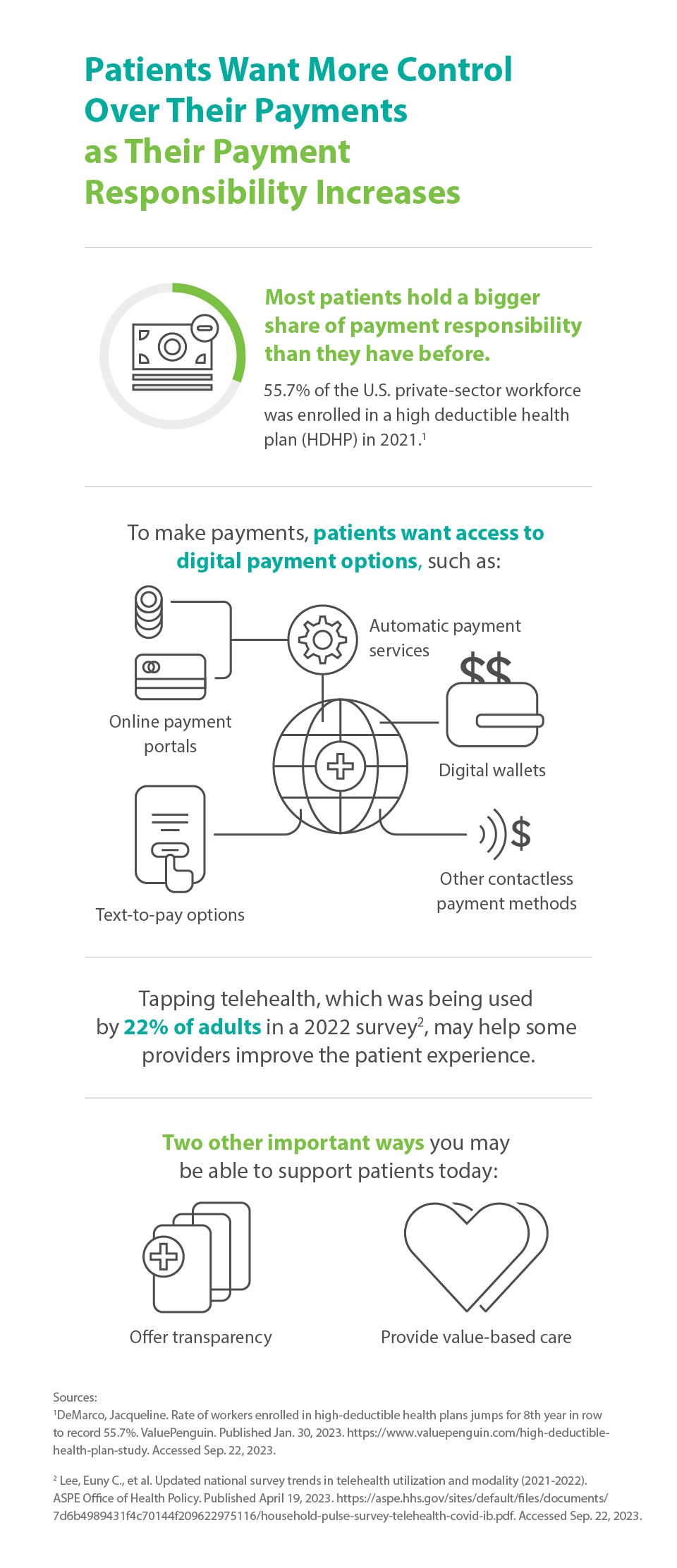

Today, patients hold a bigger share of payment responsibility than ever before. Consider these statistics:

- More than half (55.7 percent) of the U.S. private-sector workforce was enrolled in a high deductible health plan (HDHP) in 2021, according to a ValuePenguin analysis.

- HDHP plans have a deductible of at least $1,500 for an individual or $3,000 for a family in 2023.

- The annual out-of-pocket maximums for health plans in the Healthcare.gov Health Insurance Marketplace will be $9,450 for singles or $18,200 for families for 2024.

Everyone deserves access to care, and most people want to pay their bills. By putting patients' financial needs at the center of your billing and payment practices, you may improve patient financial experience. You may also offer a lifeline to patients who might otherwise forgo the care they need without flexible payment options.

Patients want a digital payment experience.

Besides flexible health and wellness financing, many patients would like to see more patient payment services, including digital payment technologies. These may include online payment portals, automatic payment services, digital wallets, and text-to-pay options.

Patients want contactless payment.

Collecting payments can sometimes be a difficult job. During the pandemic, many practices instituted contactless payments. This trend isn’t going away now that the pandemic’s over. In Mastercard’s 2022 Global New Payments Index, 62 percent of Generation Z and 69 percent of millennials said they’ve increased their use of emerging digital payments methods.

A digital payment platform may help you improve patient financial experience by offering multiple payment options, such as credit cards over the phone, online, or in-app. Also, consider making it as easy as possible for patients to pay their copayments before their appointment or at the point-of-care.

Some patients prefer telehealth.

While it may not seem like an obvious healthcare payment system trend, you may improve patient experience by tapping into the popularity of telehealth,.

Patient satisfaction scores for online visits with healthcare providers are comparable to those from traditional in-person visits. While not as many people are using telehealth as during the pandemic, 22 percent of adults reported using it in late 2021 in a pulse survey conducted by the ASPE Office of Health Policy.

Patients love healthcare transparency.

Pricing transparency in healthcare helps Americans understand the cost of a hospital procedure or service before receiving it. Transparency can help patients shop for prices that better fit their budget and allows them to plan for major health purchases. Currently, price transparency requirements extend to hospitals, urgent care, and outpatient procedure facilities. However, a growing number of practices are also opting to show their prices as well.

Healthcare transparency informs consumers, and knowledgeable consumers may make better financial decisions. For instance, patients who have more information may be more likely to pay their patient responsibility portion and avoid a costly collections process.

Patients want value.

American providers have been working toward patient-centered care for almost a decade. Value-based care is patient-centered care and also an economic trend in healthcare payments .

Value-based care isn’t just a trend in payments for Medicare reimbursement; it’s popular with patients. The fees-for-services model is outdated and confusing for many patients. It incentivizes billable treatments over outcomes. Many health and wellness consumers are looking for more value-based, patient-centric care

Solutions for Your Flexible Financing Needs

Consider staying at the forefront of current trends in payments to serve your patients with value-based, timely care. When you consider your patients’ needs and help them pay in a method that serves them best, you can help increase patient satisfaction and retention.

About the Author

Pamela Cagle

Pamela Cagle is a freelance writer based in Birmingham, Alabama. She leverages her background in healthcare and patient education to create helpful content that is informative, meaningful, and easy to understand. is a freelance writer based in Birmingham, Alabama. She leverages her background in healthcare and patient education to create helpful content that is informative, meaningful, and easy to understand.

Healthcare payment and financing solution

The CareCredit health and wellness credit card helps improve the payment experience for patients and clients, and your financial performance.

Get StartedThis content is subject to change without notice and offered for informational use only. You are urged to consult with your individual business, financial, legal, tax and/or other advisors with respect to any information presented. Synchrony and any of its affiliates, including CareCredit, (collectively, “Synchrony”) makes no representations or warranties regarding this content and accept no liability for any loss or harm arising from the use of the information provided. Your receipt of this material constitutes your acceptance of these terms and conditions.