An in-depth look at patient financing options

Discover why patients seek financing options and the pros and cons of the two of the main options for patient financing.

By Pamela Cagle

Posted Sep 06, 2024 - 7 min read

High healthcare costs and increased out-of-pocket expenses are contributing to a new kind of health crisis. Offering patient financing options is one way health systems and providers may be able to help remove barriers to care, alleviate patient stress, improve outcomes, and lower costs.

This article discusses why patients may seek financing for health and wellness, and provides information that helps patients decide which financing option may be right for them.

Benefits of Patient Financing

Patients may benefit from convenient digital payments and flexible financing options in various ways.

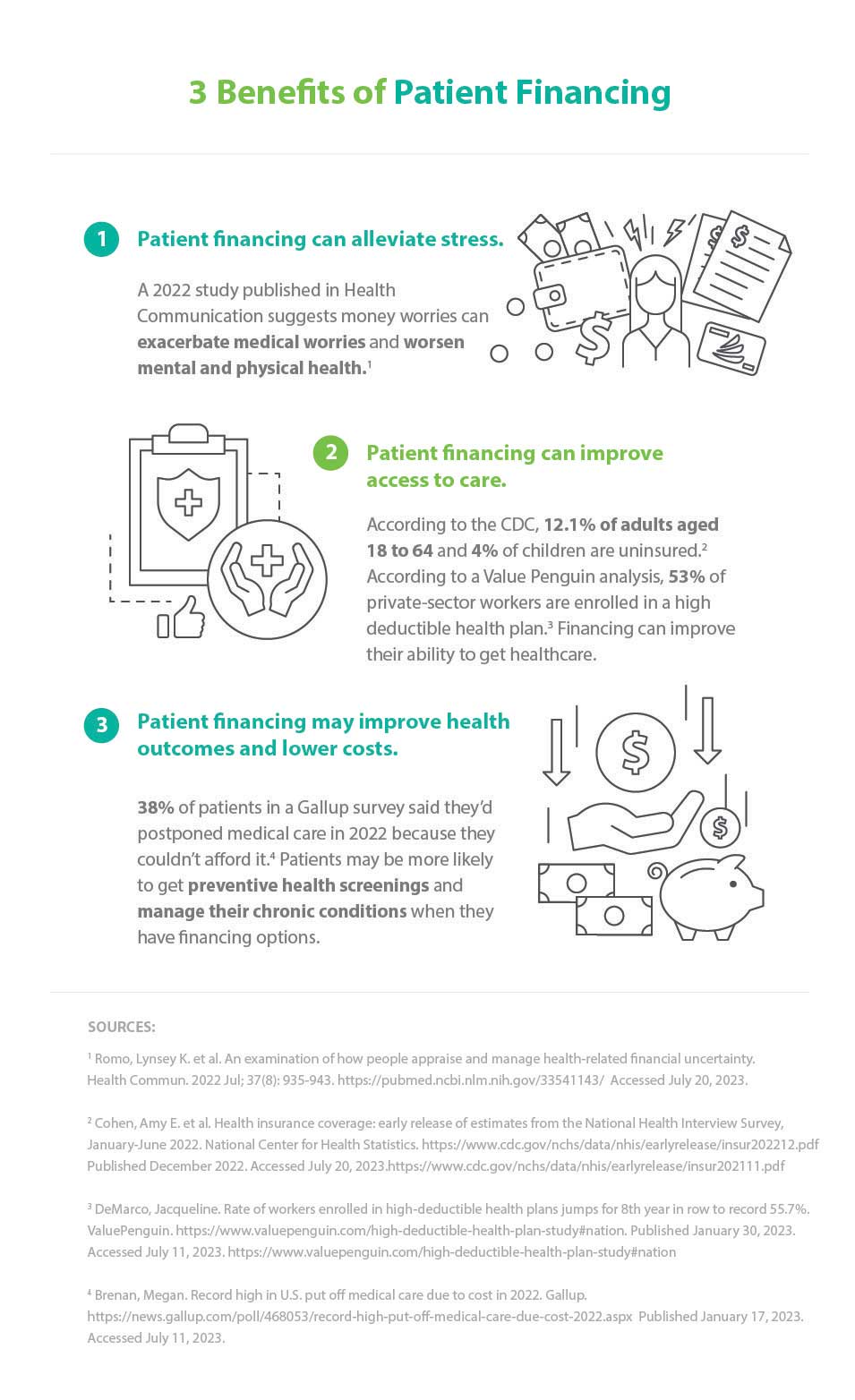

Patient Financing Can Alleviate Stress.

Stress from financial concerns can impact physical, mental, and emotional health. For example, in a small study of patients with financial concerns, money worries exacerbated participants’ medical worries and worsened their mental and physical health.

It’s possible that people who have the option to use credit responsibly to pay down medical bills may experience a decrease in their stress levels. For patients who worry about paying for a medical emergency, having a line of credit available could bring a sense of relief.

It may even feel empowering for patients to be able to take charge of their healthcare decisions, fit medical costs into their budget, and pay their bills in a way that makes sense for them and their families.

Patient Financing Can Improve Access to Care.

Everyone deserves quality healthcare. Unfortunately, high prices can cause a barrier for some. For example, patients who are uninsured may be less likely to seek care when they need it, which can make it difficult for them to manage chronic illnesses. The uninsured population in the U.S includes:

- 12.1 percent of adults aged 18 to 64

- 4 percent of children

Patients who are underinsured may also be less likely to seek care. These patients may belong to a high deductible health plan (HDHP) and have trouble paying their out-of-pocket costs. In the U.S.:

- 55.7 percent of private-sector workers are enrolled in an HDHP.

- Deductibles and out-of-pocket costs for individuals with a HDHP range from $1,400 to $7,050.

Providing these patients with payment options could immediately improve their access to care.

Patient Financing May Improve Outcomes and Lower Costs.

According to a 2022 Gallup survey, “The percentage of Americans reporting they or a family member postponed medical treatment in 2022 due to cost rose 12 points in one year, to 38%, the highest in Gallup’s 22-year trend.”

Moreover, the Kaiser Family Foundation found that 23 percent of the Americans they surveyed in 2021 said they or a family member didn’t get their prescription medications filled, skipped doses, or cut their pills in half to save money.

This research suggests patients who don’t manage their chronic diseases or get preventive care may enter the health system or practice sicker and require higher levels of care.

Patient financing can help ease the burden on patients by allowing them to manage costs. Plus, patients who can pay over time may be more likely to take part in preventive health screenings to catch diseases early when they’re easier and less expensive to treat, which could potentially lower their long-term healthcare costs.

How to Decide Between Financing Options

You have the choice of two types of patient financing options: providing financing in-house or contracting with a financing partner. Let’s examine the pros and cons of each and explore what to look for in a financing partner.

Setting Up In-House Healthcare Financing

It’s natural to want to do everything you can to help your patients cover the cost of treatment. However, you may want to carefully consider the implications of in-house financing before offering it to your patients.

Managing a healthcare financing program can take a significant amount of time and may require more employee resources. You’ll also want to have a thorough understanding of the Truth in Lending Act (TILA) which provides information about regulations and compliance laws for medical offices that are creditors.

It’s also a good idea to consult an attorney to review your plan, contracts, and policies to make sure they comply with federal and state laws that cover consumer financing transactions.

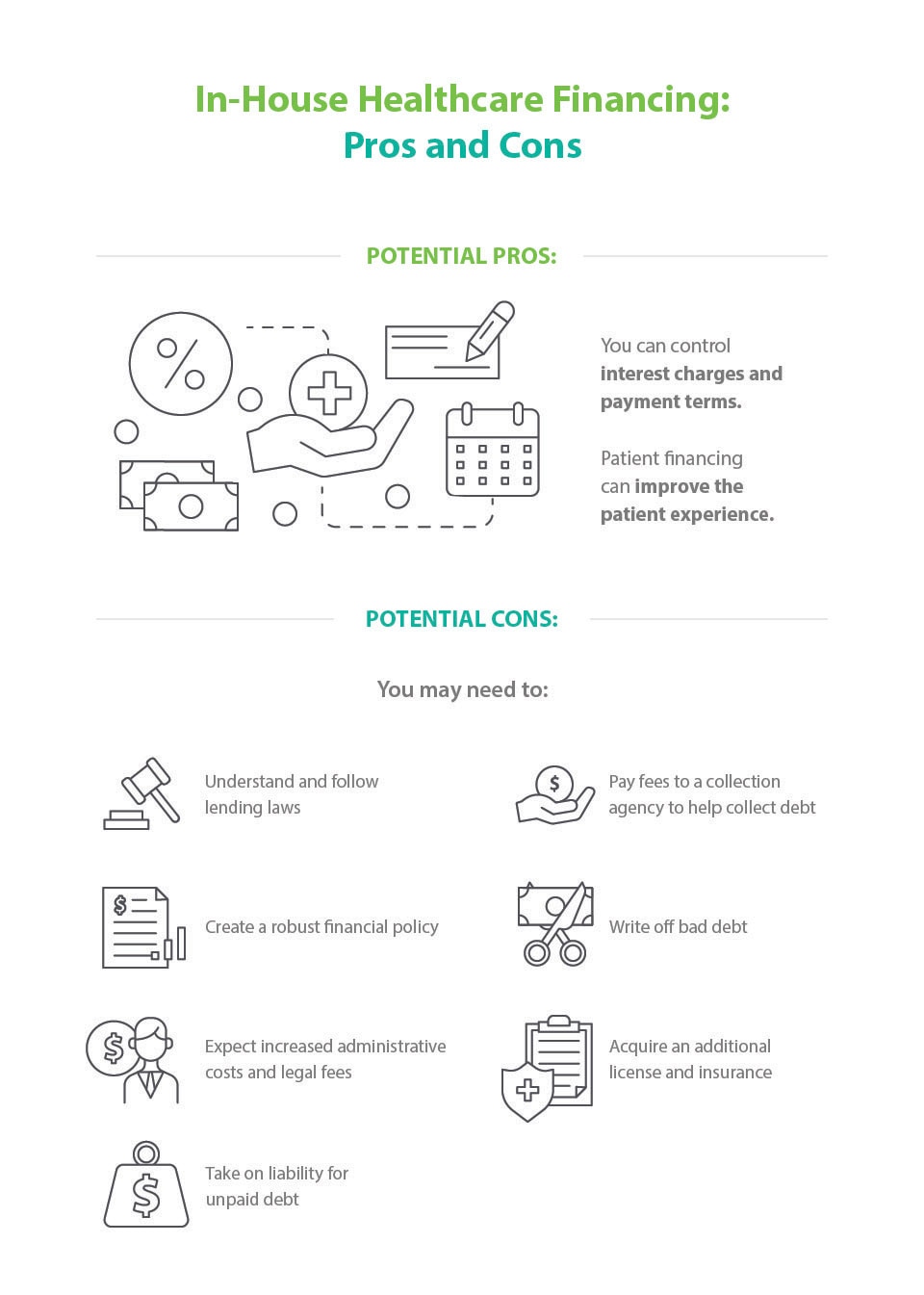

The pros of in-house financing may include:

- You can control interest charges and payment terms.

- Patient financing can improve the patient experience.

The cons may include:

- You’ll need to understand and follow lending laws.

- You may need to create a robust financial policy. (Learn how to create and implement a financial policy in CareCredit’s provider center.)

- You can expect increased administrative costs and legal fees.

- You will take on liability for unpaid debt.

- You may need to pay fees to a collection agency to help you collect debt.

- You may end up writing off bad debt.

- You may need an additional license and insurance.

Using a Financing Partner

If you opt for third-party financing, you’ll contract with an outside company that issues the patient a credit card or line of credit to use to pay for health and wellness services. A financing partner can offer your patients flexible financing while taking the risk off your health system or practice.

The pros of contracting with a financing partner could include:

- It removes most of the hassles associated with in-house payment plans.

- The company may have an online platform that provides the financing infrastructure.

- The company may provide training for your employees.

- Patient financing can improve the patient experience.

- Working with a financing partner can reduce risk through data security and underwriting.

- The financing partner will understand and meet regulatory compliance requirements.

- The partner may offer your patients flexible financing options.

The cons could include:

- You need to find a partner that’s a good fit for your culture and business goals.

Things to Consider in a Financing Partner

You will want to make sure you fully understand how each financing program works before you sign an agreement for third-party financing. Consider working with a financing partner that follows a consumer-centered philosophy. Their business solutions should bring value to your office, administration, employees, and patients while limiting your risk and liability. The vendor you choose should give special focus to the patient experience, helping patients navigate the complexities of financing for health and wellness services.

Also, it may be worth looking for a partner that will offer your staff training on how their program works, its limitations, and the payment terms. Ask for scripts if your staff will provide point-of-care sales or patient onboarding.

You may want to look for a financing partner that offers:

- Short-term and long-term financing options

- Clear financial terms

- Promotional financing options

- Online support

- A patient payment dashboard

- Instant credit decisions on applications

- Telephone support

- Data security

- Integration with your existing EHR, CRM, reporting, and accounting software

Offer Your Patients Peace of Mind

Whether you choose in-house financing or partner with a reputable healthcare financing company, you’ll help your patients’ health and well-being. If you decide to work with a financing partner, look for a trusted company that will put your patients at the center of their business just like you do.

About the Author

Pamela Cagle

Pamela Cagle is a freelance writer based in Birmingham, Alabama. She leverages her background in healthcare and patient education to create helpful content that is informative, meaningful, and easy to understand.

Healthcare payment and financing solution

The CareCredit health and wellness credit card helps improve the payment experience for patients and clients, and your financial performance.

Get StartedThis content is subject to change without notice and offered for informational use only. You are urged to consult with your individual business, financial, legal, tax and/or other advisors with respect to any information presented. Synchrony and any of its affiliates, including CareCredit, (collectively, “Synchrony”) makes no representations or warranties regarding this content and accept no liability for any loss or harm arising from the use of the information provided. Your receipt of this material constitutes your acceptance of these terms and conditions.