How to offer flexible payment options to your patients

Payment plans can benefit patients, providers, and healthcare systems. Learn more about the advantages of healthcare financing plus best practices.

By Kathy Marshall

Posted Sep 06, 2024 - 6 min read

Out-of-pocket medical expenses can quickly overwhelm patients who are already facing stressful times. A recent JAMA study estimated that nearly 18 percent of Americans have unpaid medical debt in collections. Unfortunately, many patients may ignore routine medical checkups, seek treatment only for urgent matters, or need to choose between paying their medical bills and bills for housing, gas, and groceries.

Patients may need solutions to ensure they can seek medical care when they need it without facing insurmountable financial burdens. At the same time, providers may need more consistent revenue to provide care. Keep reading to learn how patient payment solutions may provide an answer for patients, providers, and health systems.

Patients Are Payers

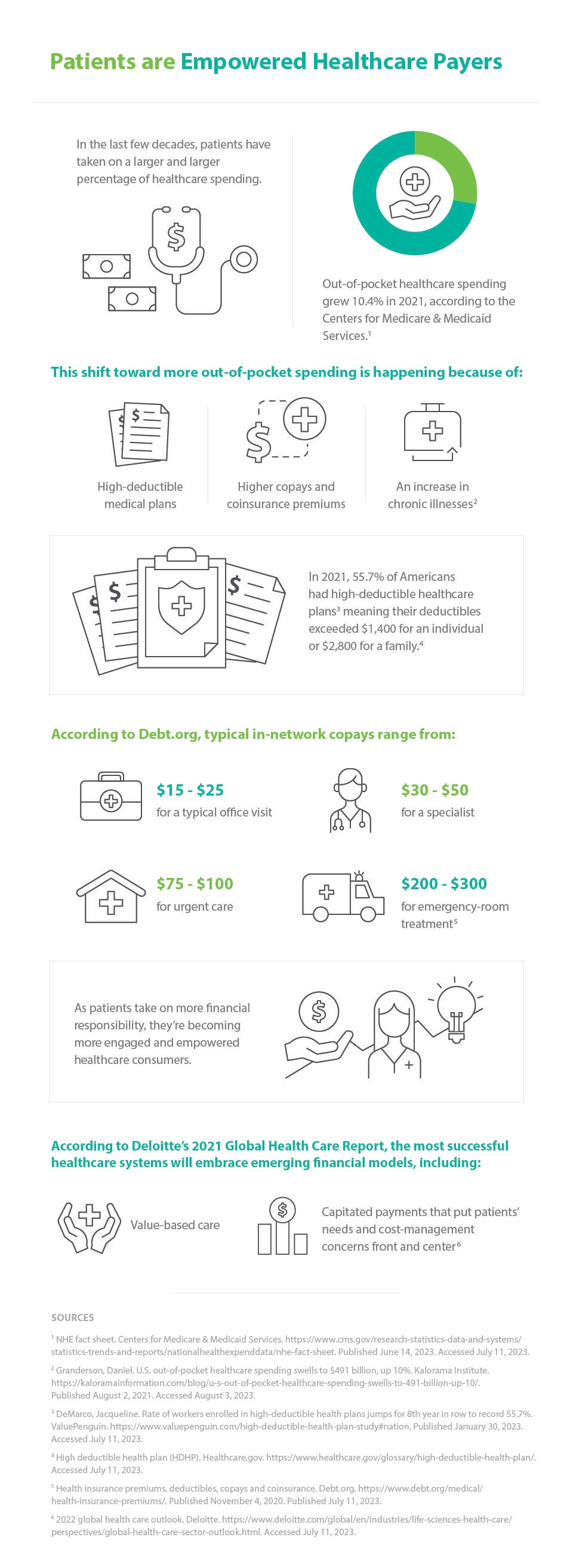

In the last few decades, patients have taken on a larger percentage of healthcare spending. For example, out-of-pocket healthcare spending grew 10.4 percent in 2021, according to the Centers for Medicare & Medicaid Services. This shift is happening because of high-deductible medical plans, higher copays and coinsurance premiums, and a rise in certain chronic illnesses.

In 2021, 55.7 percent of private-sector workers in the U.S. had high-deductible healthcare plans (HDHPs) according to a ValuePenguin analysis. HDHPs are plans with deductibles exceeding $1,400 for an individual or $2,800 for a family, Patients have additional out-of-pocket expenses as well. According to Debt.org, typical in-network copays may range from:

- $15 to $25 for a typical office visi

- $30 to $50 for a specialist

- $75 to $100 for urgent care

- $200 to $300 for emergency-room treatment

Because patients’ out-of-pocket costs are growing, the most successful healthcare systems will embrace emerging financial models that put patients’ needs and cost-management concerns front and center, according to Deloitte’s 2021 Global Health Care Report. These financial models could include flexible payment solutions for patients.

Types of Flexible Payment Options

Patient financing allows patients to pay for care over time by taking advantage of financing. Flexibility is one key to providing patient financing options that appeal to a wide array of people because everyone has a different economic situation. Let’s look at the differences between healthcare payment plans.

-

Installment plans

With these plans, a patient pays fixed payments against a balance at a regular interval and must pay off the entire bill by a specific date. Installment plans may help people budget. They provide a clear outline of a patient's expected responsibilities to cover the cost of a procedure, treatment, or service. The provider carries the collection risk for these plans. -

Recurring payment plans

With these plans, a patient sends fixed payments on a regular interval with no end date. This type of patient financing may benefit individuals or families undergoing long-term or ongoing treatments, or it may benefit patients who expect to need to pay out-of-pocket medical expenses in the future, such as for specialist care. The provider carries the collection risk for these plans. -

Third-party financing

With this payer model, a patient can take advantage of financing options provided by a financing company that partners with the provider. Some companies offer deferred-interest financing options that can improve the payment experience for patients. Meanwhile third-party financing allows the provider to shift the collection risk to another company and receive payments quickly.

Benefits of Flexible Payment Options

Patient financing can provide benefits for both patients and health systems.

-

Benefits for patients

Financing payments for routine and urgent issues can alleviate stress and eliminate worry about what-ifs. Instead of ruminating about how they’ll recover financially if someone in the family becomes suddenly ill or injured, patients can know they have a plan to pay for unexpected events.

Moreover, flexible payment options can allow patients to focus on their health and wellness and get care when they need it. They could make care more accessible to the 38 percent of people who, according to a Gallup survey, postponed treatment in 2021 due to the cost of care.

As another benefit, when patients have financing options, they can be more selective in the doctors they choose for medical treatment. A broader selection of providers and services may lead to better health.

-

Benefits for health systems

Health systems and providers also benefit from patient financing. First of all, healthcare payment options can mean patients are more likely to pay, which means providers can keep revenue flowing.

Moreover, patients may be more satisfied with their payment experience. If a health system or provider shows it’s willing to work with patients to establish realistic patient payment solutions, people may develop loyalty and be more likely to stay rather than moving on to another provider with more flexible patient payment solutions. Many people share opinions on the best place to shop, and healthcare is no different. Providers that offer patient financing may get more word-of-mouth recommendations to bring in a broader range of patients.

Furthermore, freeing up concerns about payment may allow employees to focus on providing patient care. With financing solutions, health systems and providers can also dedicate fewer resources to patient billing and collecting patient balances because they won’t need as many employees or outsourced help to do these tasks. In addition, health systems and providers can prevent communication breakdowns between third-party collectors, patients, and practices that can diminish the patient experience and decrease pay.

Best Practices

Offering patient payment solutions is just the beginning. Consider using these tips to create successful and sustainable plans.

-

Discuss payment options with patients in advance

First, consider talking about options in detail before providing any procedures or services. Patients likely want to know their options up front and discussing payment early can improve the patient experience. Consider giving patients time to thoroughly review all the requirements in a payment agreement before signing. -

Be clear about patient eligibility

Patients may think they’re ineligible for patient financing due to their financial status or other reasons, and they may not feel comfortable asking about payment plans. Clearly communicate that your financing options are available to all patients, not just a limited group. Consider putting up a sign in the office, creating an easy-to-navigate web page, and providing a detailed brochure about the patient payment solutions your office offers. -

Offer personalized options

Just as each patient is unique and requires different treatment plans, their financial needs may also vary. By offering personalized options, you may be able to help a broader range of patients receive care they otherwise may not seek. With each personalized solution, consider providing documentation for the patient that clearly explains the financing options and defines their obligations. -

Find the right financing partner

When choosing a financing partner, look for a company with integrity and healthcare experience. Just as you want to offer your patients the most beneficial and trustworthy medical care, look out for their financial health by providing the best payment solutions. Evaluate which healthcare financing plans best work for you and help you reach your goals. -

Develop clear, consistent communication

Patients likely want to have a full understanding of financial expectations. Thus, clear communication and consistency are keys to establishing a successful patient financing program. Consider creating parameters and policies and consistently operating by them. -

Automate payments

Many patients may appreciate the ease and consistency of making automated payments, and health systems and providers may benefit from regular revenue. -

Offer incentives for prompt payment

When patients know a payment plan won’t add interest for a specific amount of time, it gives them a clear benefit and a real incentive to pay. Discounts for prompt payments are another excellent tool to help patients pay and encourage them to sign up for financing options. Most people desire to pay off their medical bills and may do so with a little encouragement. Incentives may lead to more consistent and prompt payments.

Conclusion

By offering patient financing options, providers can reach more people and receive more consistent and timely payments for their services. Meanwhile, patients can feel empowered knowing they have a plan to pay for expensive or unexpected care. By instituting the best practices listed above, you can serve all your patients regardless of their financial needs while helping to improve your financial performance.

About the Author

Kathy Marshal

Kathy is a freelance writer specializing in health and wellness content. She lives in Kentucky with her husband, son, and energetic Beagle and spends much of her time at the ball fields.

Healthcare payment and financing solution

The CareCredit health and wellness credit card helps improve the payment experience for patients and clients, and your financial performance.

Get StartedThis content is subject to change without notice and offered for informational use only. You are urged to consult with your individual business, financial, legal, tax and/or other advisors and/or medical providers with respect to any information presented. Synchrony and any of its affiliates, including CareCredit, (collectively, “Synchrony”) makes no representations or warranties regarding this content and accept no liability for any loss or harm arising from the use of the information provided. Your receipt of this material constitutes your acceptance of these terms and conditions.