Helpful Strategies to Review and Improve Your Medical Billing Process

Medical billing plays a crucial role in healthcare. Read on for smart strategies to review and improve the medical billing process for your patients.

By Pamela Cagle

Posted Sep 06, 2024 - 7 min read

Medical providers are usually more passionate about improving and saving lives than billing. But revenue flow is essential for success, and health systems and providers need to prioritize timely and accurate billing.

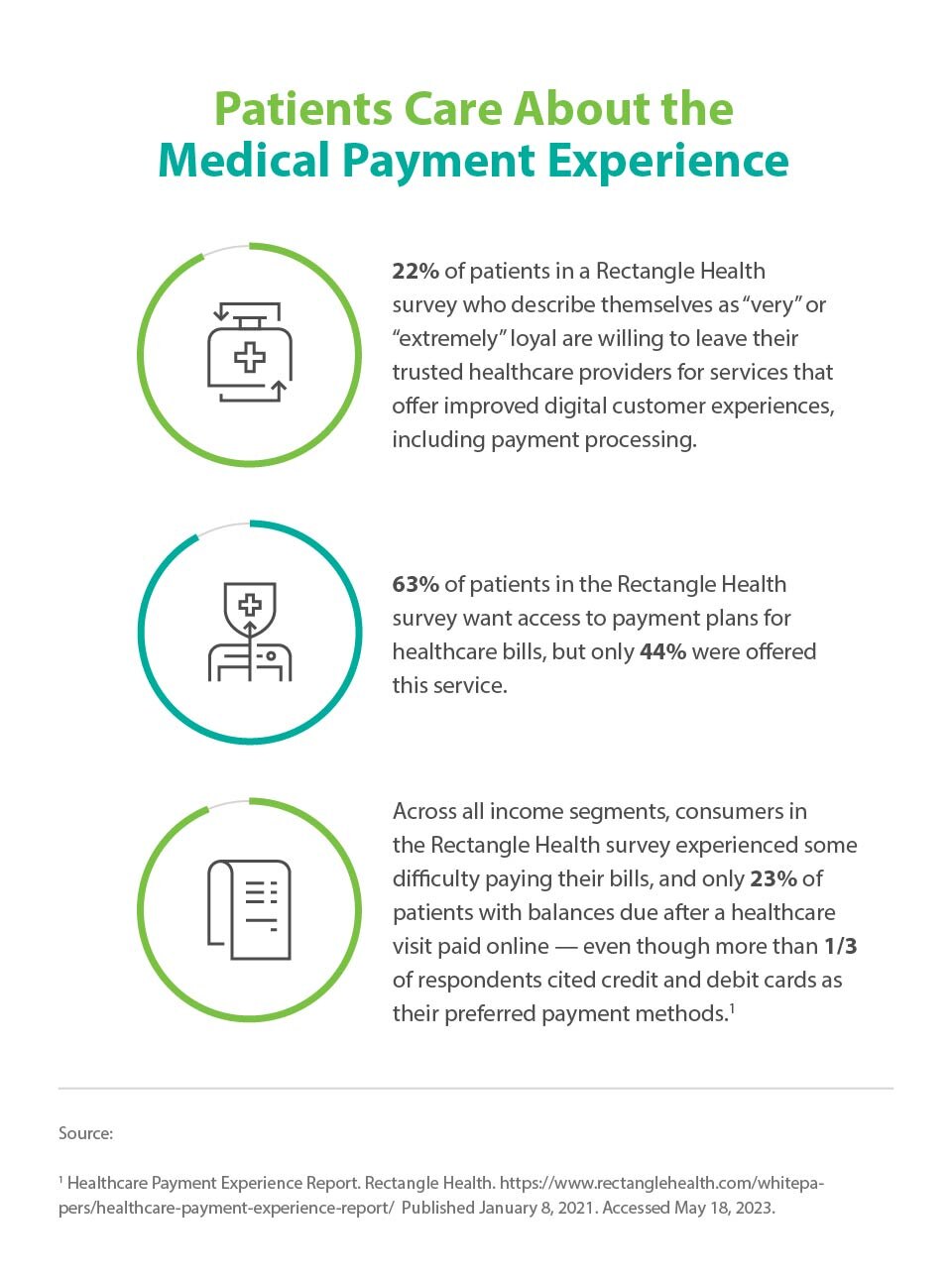

A successful billing process begins with the right information. In fact, the 2021 Healthcare Payment Experience Report from Rectangle Health found that consumers across all income segments experienced some difficulty when it came to paying their bills — partly because they found it difficult to get the necessary information to make a payment. On a positive note, you may be able to take simple steps to improve your payment and billing process and collections. In this guide, you’ll learn strategies to help streamline workflow, ensure compliance, increase revenue, and improve the patient experience.

Medical Coding and Billing

First, let’s get down to basics. Medical billing and coding is the process of submitting patient data from treatment records, often called the “superbill,” to insurance companies or third parties for payment. The healthcare industry, government, and patients depend on health systems and practices to record, register, and keep track of each patient's account to charge patients accurately for the services they receive.

What is the billing and claims process?

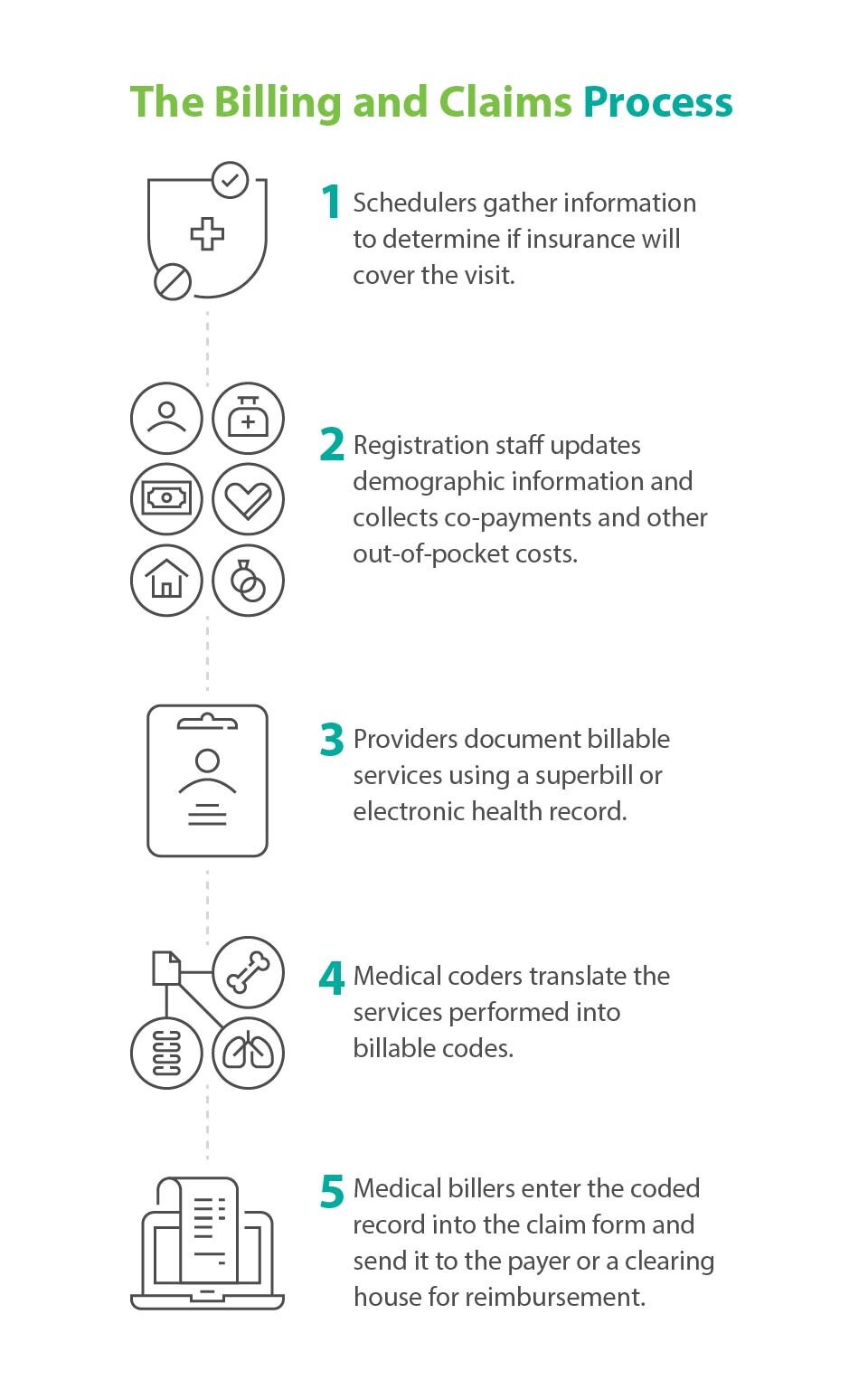

Claims processing refers to a series of steps that document any billable activities along a patient’s journey from registration through treatment and follow up. Successful claims processing is a joint effort that can include the following team members.

Scheduling

When a patient calls your office for a new appointment, a scheduler gathers basic information to determine if insurance will cover the office visit.

Registration

Upon arrival, new and existing patients hand over their insurance cards and government IDs. Then they fill out paperwork to update their demographic information. This process is critical since correct patient data can help prevent denied claims. When the patient checks out, the front office staff begins the revenue cycle by collecting copayments or other out-of-pocket costs.

Providers

After the patient completes the initial paperwork, they have their office visit, procedure, or test. During the appointment, the physician or healthcare provider documents all billable services using a superbill or digitally annotates the visit via an electronic health record (EHR).

Medical coders

After the patient’s appointment, a medical coder receives their chart or EHR. Coders translate the providers’ notes about services into billable codes. Codes vary based on the services provided and the level of care.

Medical billers

Next, the coder sends the coded record to the biller who enters the information into the claim form either manually or using billing software. When complete, the biller sends the claim to the payer or a clearinghouse for reimbursement.

How to Improve the Medical Billing Process

Following each step in the claims-paying process precisely may ensure timely payments, improve patient experience, and reduce the risk of healthcare fraud. Often, health systems and providers can improve the billing process. Here are some ways you may be able to streamline and improve revenue cycle management.

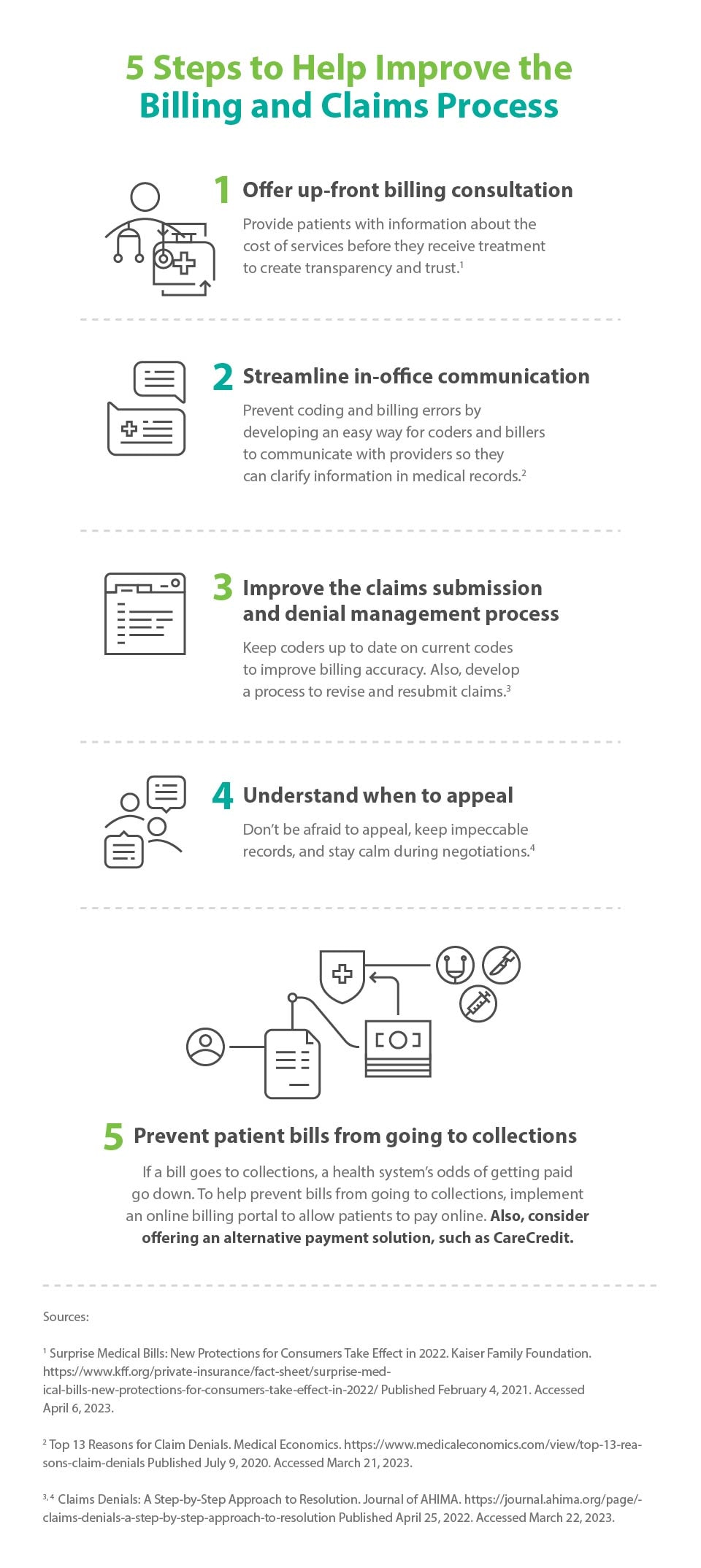

1. Offer up-front billing consultations

Today, patients may be more informed than ever before. Whenever possible, you may want to provide patients with information about the cost of services before they receive treatment, which can build trust and transparency.

2. Streamline in-office communication

Traditionally, the superbill was the only communication between scheduling and registration, clinicians, and coders and billers. A great tool for the provider for billing purposes, it also provided information about follow-up scheduling and patient billing data. In many offices, the electronic health record (EHR) has replaced the superbill.

These records work well but can be challenging for medical billers to interpret. While it may be easier for providers to check boxes next to billable events, they could overlook the necessary details required to support the procedures. If the documentation doesn't match the charges, or if any information is unclear, the biller may need to clarify the ambiguous language with the clinician.

You may be able to improve efficiency by making it easier for billers to fact-check codes. In small offices, the office manager may facilitate back-and-forth communication between clinicians and billers. Busier practices may favor text messaging or priority email to help billers quickly reach providers or their designated assistants.

3. Improve the claims submissions and denial management process

Research suggests common reasons insurers reject claims include:

- Duplicate claims

- Patient ineligibility

- Deductibles

- Bundled services

- Benefit limits

- Missing or invalid code modifiers

- Location inconsistencies

- Insufficient documentation to support the level of care

- Coding or data errors

- Dual insurance coverage

- Lack of prior authorization for a specialized procedure

- Expired filing deadline

When you submit claims to the insurance company, you may need to verify the correct billing format, append the proper modifiers, and submit all required documentation with each claim. In most offices, staff submits claims using billing software. Learning to use the software may be essential for successful billing and to prevent claims denials.

If everything goes smoothly, insurers pay claims without time-consuming follow up. Here are a few strategies that may help improve those odds.

Keep current on new codes

The job of a medical coder is to analyze data. Every procedure performed in a medical setting has a specific code assigned to it. Coding professionals need to code properly to ensure correct billing and maximum reimbursement for the physician or facility. To do so, staff must stay current on coding guidelines, including the ever-changing procedure codes as determined by the American Medical Association (AMA) and the Centers for Medicare & Medicaid Services (CMS).

Revise and resubmit claims quickly

Before denying a claim outright, the third-party payer or insurance company often gives the provider a chance to modify the claim. Consider developing a process to revise and resubmit claims to help reduce costs and encourage faster payment.

4. Understand when to appeal

First of all, don’t be afraid to appeal! If something goes wrong during the process and the payer doesn't pay or sends the wrong amount, consider filing an appeal. You may improve your outcome on appeals with two basic strategies:

- Keep impeccable records

- Stay calm during negotiations

For best results, use the exact verbiage from your contract to formulate the appeal.

If a payer repeatedly pays late, consider appealing in violation of prompt pay. Prompt pay rules define the amount of time in which a payer must pay a claim after receipt. These statutes are different in each state, so look up the statute that applies to your provider. If the payer doesn't pay within the specified time frame, the statute usually obligates additional interest payment, which accrues for each day the payment is overdue.

5. Prevent patient bills from going to collections

According to the American Hospital Association (AHA), bad debt consists of services that hospitals anticipated but did not receive payment for. In 2020, uncompensated care in community hospitals accounted for $42.67 billion. One way to prevent bad debt is to use the strategies below to encourage patients to pay their bills before they go to collections.

- Is there a copay? If so, you may want to collect it before the patient leaves the office.

- Is there any unmet deductible? If so, notify the patient.

- Is the patient out-of-network, and if so, what are the out-of-network benefits? Consider alerting patients to additional costs for using an out-of-network provider.

- Is the visit a procedure for which a patient may need to pay a deductible or coinsurance obligation? If so, it may be a good idea to let the patient know as soon as possible so they can budget accordingly.

Also, consider these two strategies to help prevent the collection process in medical billing.

Implement a Patient Billing Portal

A billing portal — integrated into an easy-to-navigate patient portal — can be part of a larger patient engagement strategy. But despite the demand for online billing access, only 21 percent of patients at group practices and 25 percent of patients at private practices who were surveyed in a 2021 PYMNTS study paid medical bills on the provider’s website. Online payment portals are more likely to convert payments than paper billing because they meet patients online where they are.

To ensure success, work with an expert to design your portal from a patient’s perspective and remember that an effective billing and collections strategy prioritizes the needs of the patient over the biller. For starters, cost transparency goes a long way. According to The Payment Cure: How Improving Billing Experiences Impacts Patient Loyalty, a joint report between PYMNTS and CareCredit published in September 2021:

- 65 percent of patients surveyed said being made aware of the potential cost of treatment before an appointment creates an overall positive experience.

- Yet only 30 percent of patients could access a cost estimate before treatment.

Offer more ways to pay

Over the last decade, healthcare has moved from a strict fee-for-service model to offering bundled services and value-based care. This shift toward patient-centric models reflects the desire of today’s healthcare consumers to take charge of their health.

Due to high-deductible healthcare plans, some patients may avoid insurance companies altogether, preferring to pay for services, tests, and procedures on their terms.

Moreover, some health systems and practices may work with financing partners to offer their patients flexible ways to pay. When patients use the CareCredit credit card as a payment option, for example, immediate benefits include:

- Providers get paid within two business days with no recourse if a patient defaults.*

- Patients can move forward with the care they want and need.

- Health systems and practices may be able to reduce accounts receivable and improve revenue cycle management.

Trust the Process and the Pros

Medical billing and collections are a vital part of healthcare. Hospitals, doctors, and clinics depend on the process to get paid, keep track of a patient's medical experience, and keep practices running smoothly. Medical billers are an integral part of the medical practice. They have daily interactions with providers, patients, and payers, and they’re responsible for billing insurance companies, the government, and patients correctly. Help empower billing staff by implementing the above strategies, which may improve your medical billing process while assisting patients to get the care and treatment they need.

About the Author

Pamela Cagle

Pamela Cagle is a freelance writer based in Birmingham, Alabama. She leverages her background in healthcare and patient education to create helpful content that is informative, meaningful, and easy to understand.

Healthcare payment and financing solution

The CareCredit health and wellness credit card helps improve the payment experience for patients and clients, and your financial performance.

Get StartedThis content is subject to change without notice and offered for informational use only. You are urged to consult with your individual business, financial, legal, tax and/or other advisors and/or medical providers with respect to any information presented. Synchrony and any of its affiliates, including CareCredit, (collectively, “Synchrony”) makes no representations or warranties regarding this content and accept no liability for any loss or harm arising from the use of the information provided. Your receipt of this material constitutes your acceptance of these terms and conditions.