How the Health and Wellness Billing Process Works

This article explores the lifecycle of a health and wellness bill, from pre-appointment planning through the patient visit and utilization review.

By Pamela Cagle, RN

Posted Sep 20, 2024 - 7 min read

Providers understand the value of a more patient-centered approach to the entire care journey, which includes health and wellness billing and revenue cycle management (RCM). After all, 80 percent of physicians surveyed by the Physicians Advocacy Institute (PAI) “believe their patients often or sometimes refuse or delay care due to cost concerns.”

While health and wellness billing can be tricky, you can navigate this often-opaque process with more ease and improve the patient experience by considering the helpful guidance below. Keep reading for our explanation of RCM plus a walkthrough of health and wellness bills — from creation to payment and evaluation.

What Is Revenue Cycle Management (RCM)?

Revenue Cycle Management (RCM) is a multi-step process, which methodically tracks a patient’s financial journey. Successful RCM is a continual cycle that starts with the first patient contact, continues through patient care, and closes with the receipt of payment and an evaluation of what worked and what didn’t work. Technology like electronic health records (EHR), patient portals, and virtual communication can not only improve your RCM, but can also help boost patient engagement and retention.

Pre-Appointment Planning

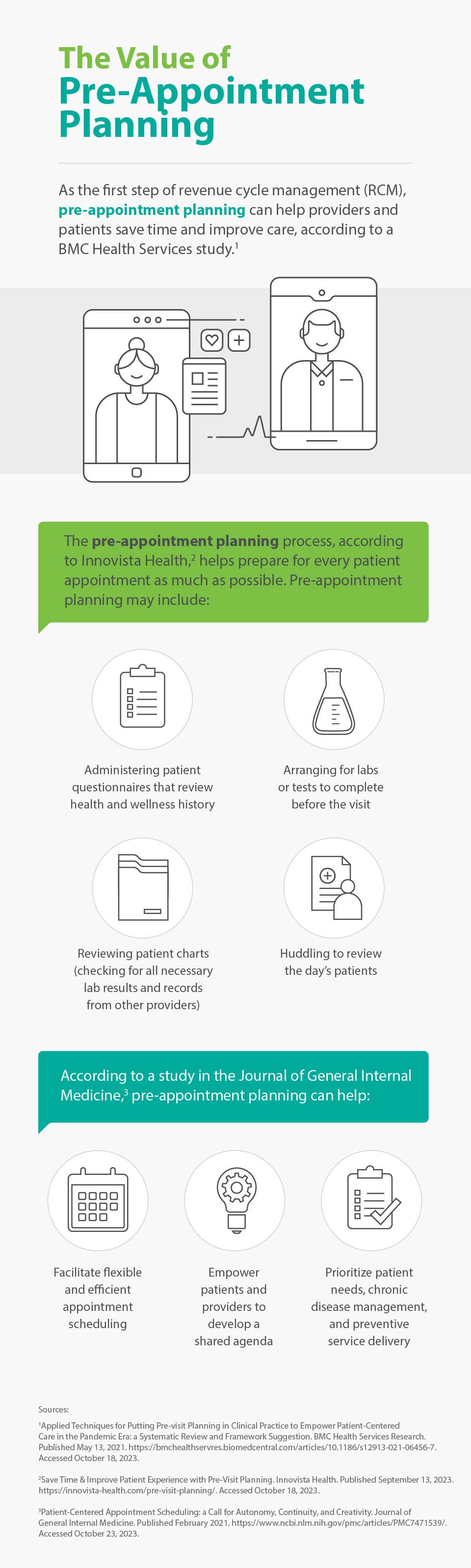

This initial phase of revenue cycle management helps ensure you have the time and information necessary to handle any unanticipated issues and make the best decisions. It saves patients time, too, and provides the opportunity for more effective communication and care during appointments.

Additionally, according to a study in the Journal of General Internal Medicine, pre-appointment planning facilitates flexible and efficient appointment scheduling, empowers patients and providers to develop a shared agenda, and prioritizes patient needs, chronic disease management, and preventive service delivery.

More specifically, pre-appointment planning allows you to accomplish the following.

1. Collect important patient information

Beyond basic demographic information, this step is all about gathering patients’ health and wellness history. For example, you may inquire about patients’ smoking status, pain level, and how many times they’ve fallen in the last year. Patients may also review and edit a printed medication list before each visit. You’ll also want to collect records from other doctors if necessary.

Pre-appointment questionnaires — sent to patients with plenty of lead time — can help you gather complete and accurate information, which will help you stay up-to-date on current patients and feel more prepared with new patients.

2. Arrange for necessary labs or tests

Make sure to order any necessary labs or screenings prior to patients’ visits. To increase the likelihood patients complete lab drawings and other tests, you can provide them with convenient lab locations and send reminder texts and emails.

When patients complete these tests ahead of time, you can have more data-driven conversations with them and they can be more engaged in treatment decision-making.

3. Verify insurance and review financial expectations

Pre-visit planning also includes a review of insurance information and a discussion of financial expectations with current and prospective patients. The insurance verification process involves collecting patient insurance information and cross-checking it with insurers. Insurance verification can help maximize your cash flow, minimize the number of denied claims, and keep your patients happy. By confirming your patients’ coverage and benefits, and getting authorization beforehand, you may have a green light to provide a range of covered services.

You’ll also want to have a discussion with your patients about their financial responsibility. Similar to verifying insurance, a review of financial expectations can improve patient experience — increasing the chances your patients follow through with the care they want and need — while reducing the likelihood for denied claims.

4. Send Reminders

Automated text, call, and/or email reminders are an easy way to help patients stay on top of their appointments and reach out to you in the event of a scheduling conflict. In fact, according to a 2023 MGMA poll, 52 percent of respondents said their patient no-show rates stayed the same in the last year while 11 percent said rates decreased. Of those who said their no shows decreased, many attributed their success to automated appointment reminders and confirmations.

And with smartphones, it takes patients just a second to add the date, time, and address from an appointment reminder to their calendars, helping decrease your no-show rate.

The Appointment

The day of an appointment includes several critical steps related to the patient billing process. It all starts with a patient’s arrival. Many providers have switched to contactless check-in to improve safety, convenience, and patient satisfaction. In fact, InstaMed’s 2022 Trends in Healthcare Payments Annual Report found that patients want more tech-savvy options when it comes to their administrative check-in and payments. Patients reflected these desires accordingly:

- 66 percent want to keep using online forms for check-in to avoid in-person wait times

- 79 percent want to keep using virtual and self-service options for healthcare payments

If your practice offers EHR with a patient portal, the entire check-in process may be automated, which could make things even easier for your employees and patients alike. During this step, you’ll want to verify your patient’s personal information as well as their insurance information. If everything is accurate and up-to-date, billing will go more smoothly.

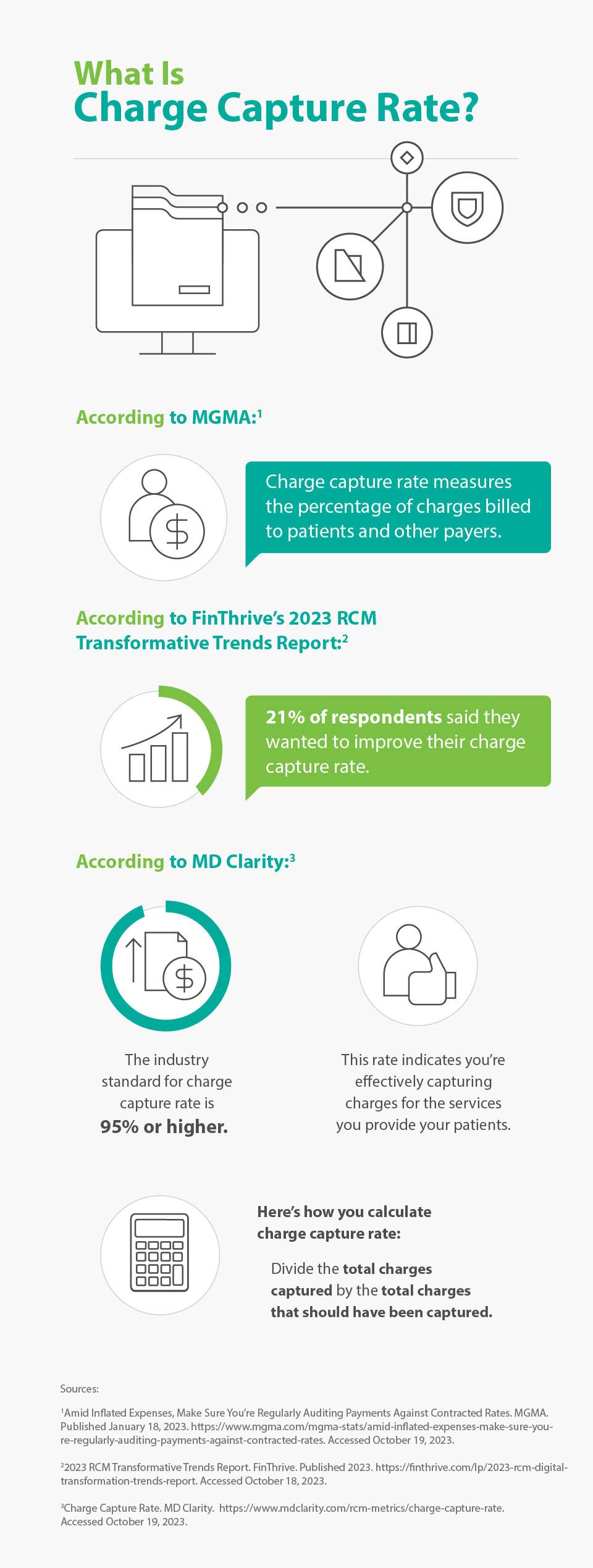

After a patient checks in and meets with their provider, their provider electronically records information about the services received during the appointment and sends it to different payers and insurance companies for reimbursement. This integral step is called charge capture. Providers and finance leaders are increasingly seeing the positive link between improved charge capture audit and analytics solutions and revenue. That’s why, according to the 2023 RCM Transformative Trends Report, 21 percent of respondents said they wanted to improve their charge capture rate.

The Lifecycle of a Health and Wellness Bill

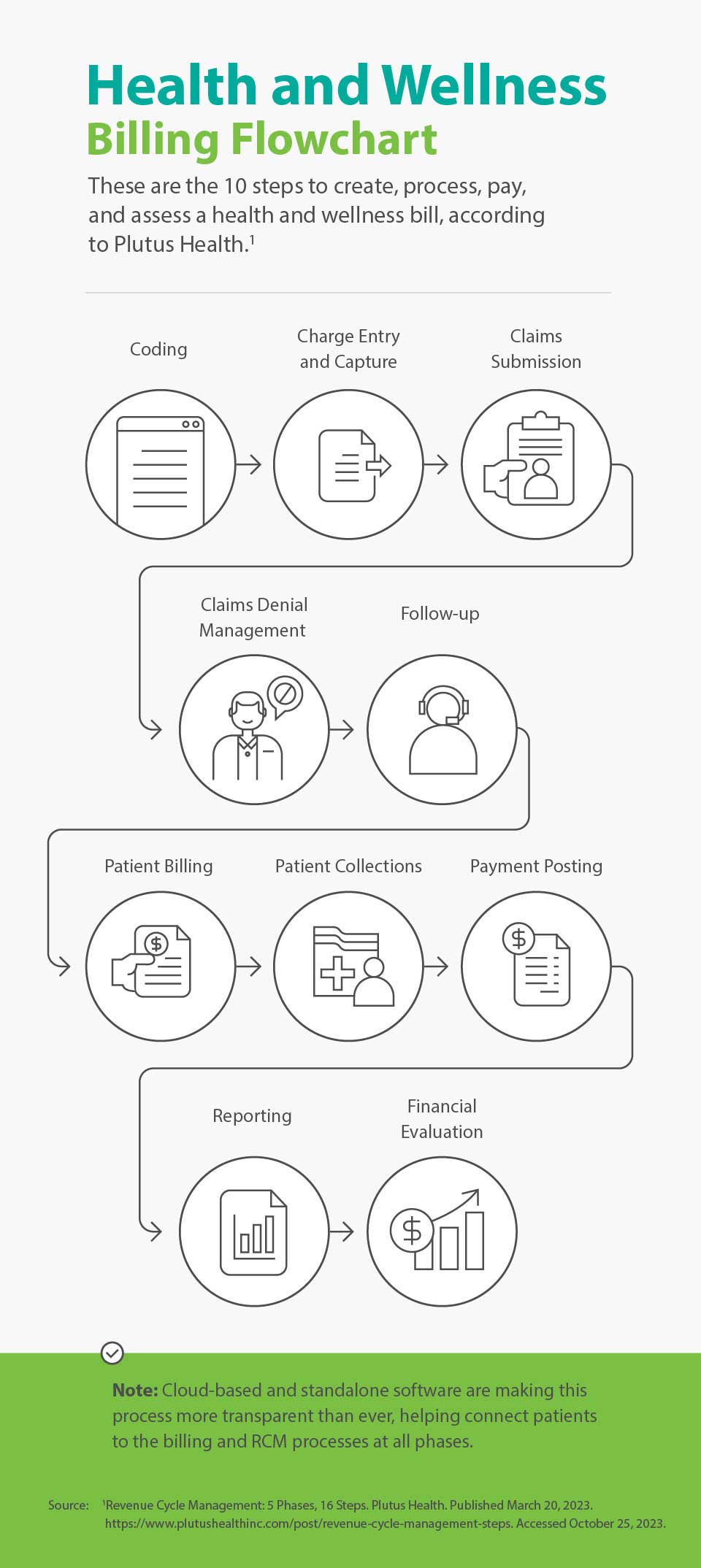

According to Plutus Health, there are 10 distinct steps in the lifecycle of a health and wellness bill after the pre-service steps we covered in the pre-appointment planning section. These next steps begin with proper identification of services and procedures and end with a metrics review.

- Coding: assigning a specific alphanumeric code to procedures, services, and diagnoses

- Charge entry and capture: assigning a monetary value to health and wellness procedures and services and then submitting those charges to the appropriate payers, including insurance and government payers like Medicare, for billing

- Claims submission: sending clean claims, meaning they have complete and accurate data, through Electronic Data Interchange (EDI) to the payers

- Claims denial management: addressing denied claims and speeding up payment for previously denied claims

- Follow-up: providing payers with corrected information or information that fills gaps in the case of denied claims

- Patient billing: sending bills to patients if they owe a balance after insurance and other payers covered their portion

- Patient collections: collecting patient payments, often with the help of automated reminders via email or letters in the mail

- Payment posting: recording payments into a billing software and helping ensure data from explanations of benefits (EOB) and electronic remittance advice (ERA) match payments

- Reporting: revealing, via RCM software or an RCM service, important billing and revenue metrics to help providers understand what’s working and what’s not

- Financial evaluation: analyzing finances as a whole and adjusting financial goals for the future

Through all these phases, embracing technology can be a key factor in the efficiency and success of your billing process. According to a 2022 PYMNTS report, online portals are quickly becoming the preferred way to pay for health and wellness expenses. While 23.8 percent of consumers in the report said they usually paid for health-related services in person, consumers cited digital portals as the second most common payment option, with 16 percent saying portals are their primary payment channel.

The Final Process: Utilization Review

Utilization review is an important final step in RCM, though it also plays a role before and during care. Not only does it help ensure the appropriate, necessary, and efficient use of health and wellness services, but it can also boost patient satisfaction and outcomes by helping control costs, improve quality of care, ensure compliance with any necessary regulations.

Conclusion

The evolution of care is a core principle of health and wellness — meaning that, ideally, providers can benefit from seeking new methods to streamline and enhance the patient experience. And yes, this principle includes something as seemingly administrative as the billing process. By understanding each fundamental step of RCM and taking the time to assess which areas need work, you’ll not only help improve your bottom line — you’ll offer your patients better care and greater peace of mind, too.

About the Author

Pamela Cagle

Pamela Cagle is a freelance writer based in Birmingham, Alabama. She leverages her background in healthcare and patient education to create helpful content that is informative, meaningful, and easy to understand.

Healthcare payment and financing solution

The CareCredit health and wellness credit card helps improve the payment experience for patients and clients, and your financial performance.

Get StartedThis content is subject to change without notice and offered for informational use only. You are urged to consult with your individual business, financial, legal, tax and/or other advisors with respect to any information presented. Synchrony and any of its affiliates, including CareCredit, (collectively, “Synchrony”) makes no representations or warranties regarding this content and accept no liability for any loss or harm arising from the use of the information provided. Your receipt of this material constitutes your acceptance of these terms and conditions.