Hate talking about money? You are not alone

Insights from a CareCredit survey can help veterinarians with steps they can take to help them get paid on time and in full.

By Amy L. Grice

Posted Aug 24, 2022 - 7 min read

CareCredit, which offers a financing solution to veterinary clients, commissioned a survey to better understand how equine veterinary professionals balance their love of the profession (and horses) with the business side of running their practices. The survey, fielded in December 2020, resulted in 100 surveys used in analyzing the data. Of those responses, 46 were from practicing veterinarians and 54 were from office managers, practice managers, office administrators or veterinary technicians. 74% of respondents were from equine-only practices. Of those, 2% offered only specialty services, 42% offered general and specialty services, and 30% provided general practice services. The remaining respondents (26%) were in mixed practice. Of the horses cared for by the respondents’ practices, 70% were used for pleasure. The respondents’ gender was 56% female and 42% male, with an age range of 24 to 82 years.

Most vets surveyed don’t like financial conversations

When asked “Who in your practice is primarily responsible for FINANCIAL CONVERSATIONS with clients and for COLLECTING receivables?”, it became clear that most equine veterinarians prefer not to talk about money with their clients. If that sounds like you, you now know you are not alone in your avoidance of financial conversations.

The survey showed that 90% of the veterinarians were not involved in the financial conversations with clients, and 95% of the veterinarians were not involved in collections.

Why payment conversations are difficult?

An open-ended question asking “What makes having payment conversations with clients difficult?” yielded an interesting difference between veterinarian and staff responses. Doctors were much more likely to express that talking about finances was difficult, stressful or complicated compared to staff members, with 75% of veterinarians expressing negative feelings versus only 40% of lay staff.

The three core issues that arose for veterinarian respondents regarding financial conversations were:

- the desire to focus on patient care rather than money;

- the perception that they lack information or details about financial arrangements or policies; and

- the personal discomfort with talking about earning money for their services.

Horse owners value the services that veterinarians provide. Veterinarians do themselves a disservice when they feel bad about earning a living taking good care of horses, or they don’t charge appropriately.

Most practices have client financial policies

Respondents were asked “Does your practice have formal written financial policies you provide to clients regarding your payment expectations? How do you currently communicate payment options to your clients?” The study found 78% of practices had policies, and they communicated their expectations and payment options to clients. A new client packet that included these policies was the most prevalent way these expectations were disseminated. But that result also means that nearly one-quarter of respondents did not have written financial policies for clients.

Following or enforcing the policy for clients concerning bill pay is a common downfall of equine veterinary practices. Often new clients will more readily adhere to these policies than “legacy” clients who have been trained by their veterinarians to expect an invoice in the mail once a month and to have 30 or more days to pay that invoice.

Why practices waive fees

When queried “Why or when do you reduce or waive fees for services?”, the most common reasons (48%) for discounting fees were client hardship, inability to pay the full amount of the invoice, or client expectation that the charges would be lower.

About 28% said they reduced fees to ensure some payment, and 15% stated that they charged less because of a relationship with the client or a one-time need. Other respondents gave discounts when a client was willing to pay in cash; to save the horse’s life; when there was a bundle with other services; when the patient died; or to increase goodwill with a client.

From a business management standpoint, it is important to note that discounting services can reduce the practice’s profit, which can lower practice value while simultaneously training clients to expect lower fees.

When clients have overdue accounts, the survey respondents stated that they send or text reminders, utilize phone calls, mail invoices with billing options or collect before a new service is provided or at the time of the next service. They also might refuse further service, send the bill to collections, reduce fees or—after a period of time—write off the amount.

Shifting to a mindset and business strategy focused on getting paid at the time of service and building healthy financial relationships with clients can alleviate this predicament. A good first step is establishing clear expectations and having a policy that clearly states that clients will pay at time of service. Having credit cards on file for every client can make payment efficient and convenient, especially for absentee owners.

It is essential that practice owners follow their own policies or the system will not be viable. Staff members doing their best to collect fees from clients according to the practice “rules” might lose their motivation if the practice owners do not back them up or ignore the policies for their favorite clients.

When clients can’t pay

When asked “How often do you reduce or waive fees for services due to a perceived/ actual ability of a client to pay?”, 61% of respondents replied that they will reduce or waive fees mostly on an ad hoc basis. This finding shows that equine veterinarians put the needs of clients before their own financial needs.

Equine veterinarians can often find themselves conflicted between the medical/ surgical care a horse needs and a client’s willingness or ability to pay. This survey asked, in that circumstance, “What do you do, and why?” The respondents indicated three core ways they deal with an inability to pay for care.

- They provide the care anyway and leave the financial aspect to someone else in the practice. In a solo practice, this often means performing the care for free.

- Veterinarians seek to communicate well, give options, modify payment plans, extend credit, suggest financing options such as the CareCredit credit card, or work out a payment plan with the practice.

- When these options are insufficient, doctors might be forced to walk away from a need or make a difficult choice for euthanasia.

Enhancing financial relationships

Respondents were asked “If you could do one thing to create a great financial relationship with your client, what would it be?” The respondents were aligned in stating that providing payment options and eliminating collection issues were the top two ways to create a great financial relationship with the client. Veterinarians’ third-most-chosen-way was open communication, and staffs’ third-most-common choice was having well-written, workable financial policies.

The good news is that 78% of respondents said clients adhere to their financial policies. However, that leaves a substantial number of horse owners who are not following those financial policies.

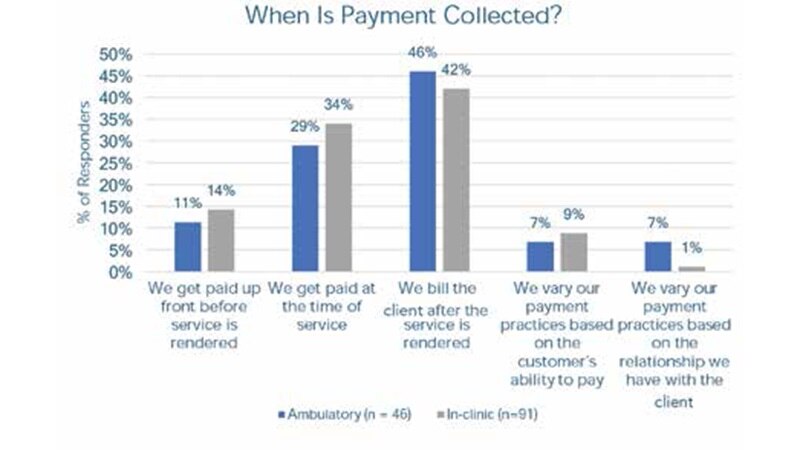

How and when clients pay

The survey results showed that 75% of respondents are paid with a credit card (49%) or by check (26%).

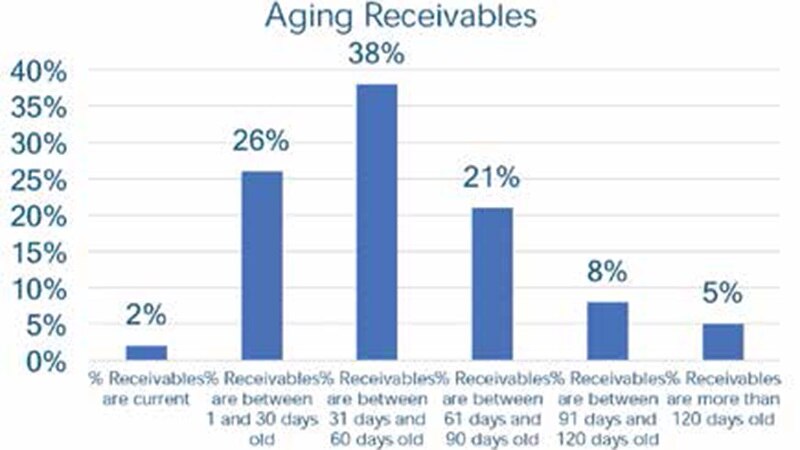

The survey also revealed that 72% of respondents had aging accounts receivable that were greater than 30 days. While generally those practices that send monthly invoices are paid within 30-60 days, 34% of accounts in this study were not paid by 60 days.

Having financial policies requiring full payment at the time of service can dramatically improve cash flow and reduce accounts receivable. In my experience, accounts receivable over 90 days are often uncollectible.

For ambulatory practitioner payment, the respondents said the most effective solutions included having a credit card on file, providing pre-payment plans, calling or texting about payment policy and estimated costs prior to a visit, providing a cash discount, and pre-authorizing credit cards before the visit. For payment of in-hospital services, respondents offered the following solutions: require payment up front, put a credit card on file, pre-authorize payment, tighten payment policies, communicate policies early and often, reduce time to invoice, and offer a discount for cash payment.

Take-home message

Getting paid in full at the time of service is beneficial for equine veterinarians, and a culture shift that prioritizes this mindset is within reach. This survey elucidates the discomfort and difficulty felt by veterinarians over fee collection. 75% of survey veterinarians found it very difficult to talk about money. Vets noted that they just wanted to concentrate on patient care; they didn’t know the details of what could be offered financially; or they just were personally uncomfortable talking about money, especially in relation to services they were providing.

Equine veterinarians properly communicating payment options can help clients pay in full at the time of service. For example, with the CareCredit credit card, veterinarians can get paid immediately, and clients can use the card repeatedly for their horses’ care as a convenient way to pay.

Steps veterinarians can take to make practices more profitable and their lives less stressful include creating clear policies that all team members (including practice owners) follow; training staff to be more comfortable with financial conversations; and client communication that increases adherence to financial policies.

Healthcare payment and financing solution

The CareCredit health and wellness credit card helps improve the payment experience for patients and clients, and your financial performance.

Get StartedThis content is subject to change without notice and offered for informational use only. You are urged to consult with your individual business, financial, legal, tax and/ or other advisors with respect to any information presented. Synchrony and any of its affiliates, including CareCredit, (collectively, “Synchrony”) make no representations or warranties regarding this content and accept no liability for any loss or harm arising from the use of the information provided. All statements and opinions in this article are the sole opinions of the author. Your receipt of this material constitutes your acceptance of these terms and conditions.